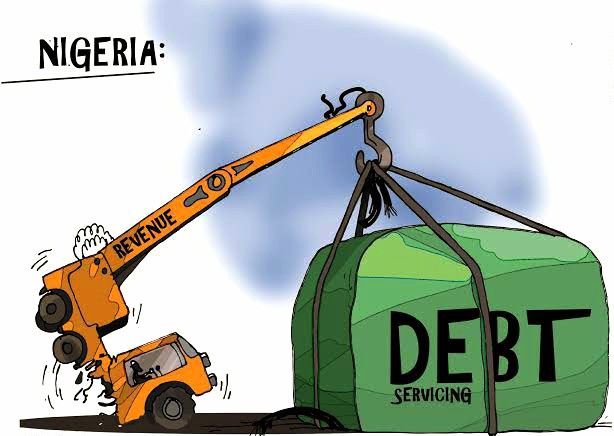

FG’s Deduction of N415bn State Allocations Exposes Nigeria’s Growing Debt Crisis

In light of recent findings by Reporters, the Federal Government has implemented deductions of over N415 billion from state government allocations to address their external loan obligations. Data sourced from the Federation Account Allocation Committee Disbursement reports, as published by the National Bureau of Statistics, reveals a consistent trend of deductions between 2019 and 2023. These deductions, part of the federation account management framework, encompass statutory allocation, Value Added Tax distribution, and derivation principles.

The analysis delineates a progressive increase in deductions, with sub-national entities bearing the brunt of financial adjustments. Notably, deductions surged from N57 billion in 2019 to N120.01 billion by December 2023, signaling a staggering 110 percent escalation amidst revenue constraints. Lagos State emerges as the most impacted, grappling with deductions amounting to N131.1 billion for external debt servicing, trailed by Kaduna and Cross River with N45.85 billion and N21.59 billion respectively.

Meanwhile, other states, including Oyo, Rivers, Ogun, and Edo, contend with varying degrees of deductions ranging from N18.25 billion to N10.92 billion, indicative of widespread financial strain. Conversely, Borno, Yobe, and Zamfara registered relatively lower deductions, underscoring regional disparities in debt servicing burdens.

Nigeria’s Debt Spiral: 108 World Bank Loans, $14 Billion Burden, and Rising Domestic Borrowing Undermine Fiscal Stability amidst Federal Government Deductions of Over N415 Billion from State Government Allocations

This financial landscape is further accentuated by Nigeria’s servicing of 108 World Bank loans valued at $14 billion, as highlighted in recent reports. Notably, personnel costs and debt servicing have surpassed government revenue projections for 2022, as underscored by the World Bank. Despite these fiscal challenges, the federal government continues to engage in borrowing activities to sustain its operations.

Recent revelations indicate a substantial reliance on domestic borrowing, with the government securing N4.94 trillion from domestic sources within the initial six months of President Bola Tinubu’s administration. Notably, domestic debts surged from N48.3 trillion in June 2023 to N53.3 trillion by December 31, 2023, with a marked increase in servicing obligations. In 2023 alone, Nigeria disbursed a staggering N7.8 trillion toward debt servicing, marking a significant 121 percent surge from the previous year’s expenditure.

The breakdown of domestic debts highlights extensive reliance on various financial instruments, including FGN bonds, treasury bills, savings bonds, Sukuk loans, and promissory notes. Concurrently, external debt obligations witnessed an uptick, particularly from the African Development Bank and the Exim Bank of China, reflecting a burgeoning debt profile. This trajectory appears at odds with the Tinubu administration’s pledge to curtail borrowing and prioritize revenue augmentation strategies, underscoring the complexity of Nigeria’s fiscal landscape amidst escalating debt dynamics.

Naija!